FHA Loans

Formed in 1934 by Congress, the Federal Housing Administration (FHA) insures private loans issued for new and existing housing, as well as for loans approved for home repairs. It acts as a buffer to lenders by reducing their risk in issuing loans, and helps borrowers qualify for the mortgages they desire. FHA loans are available to everyone looking to purchase or refinance a home. FHA mortgages are insured by the Federal Housing Administration, a federal agency within the Department of Housing and Urban Development. FHA mortgages are government-assisted alternatives to conventional financing and are great options for those who want to put less money down or who have lower credit scores. They are popular for home purchases and for refinancing. FHA loans don’t carry the income limits that you might find with other first-time homebuyer programs. However, there are limits on how much you can borrow. While these mortgages do require expenses in the form of monthly mortgage insurance, they still enable many homeowners who don’t qualify for conventional financing to purchase or refinance a home.

Advantages of an FHA loan include:

- Put as little as 3.5% down

- 100% of down payment and closing costs may be gift funds

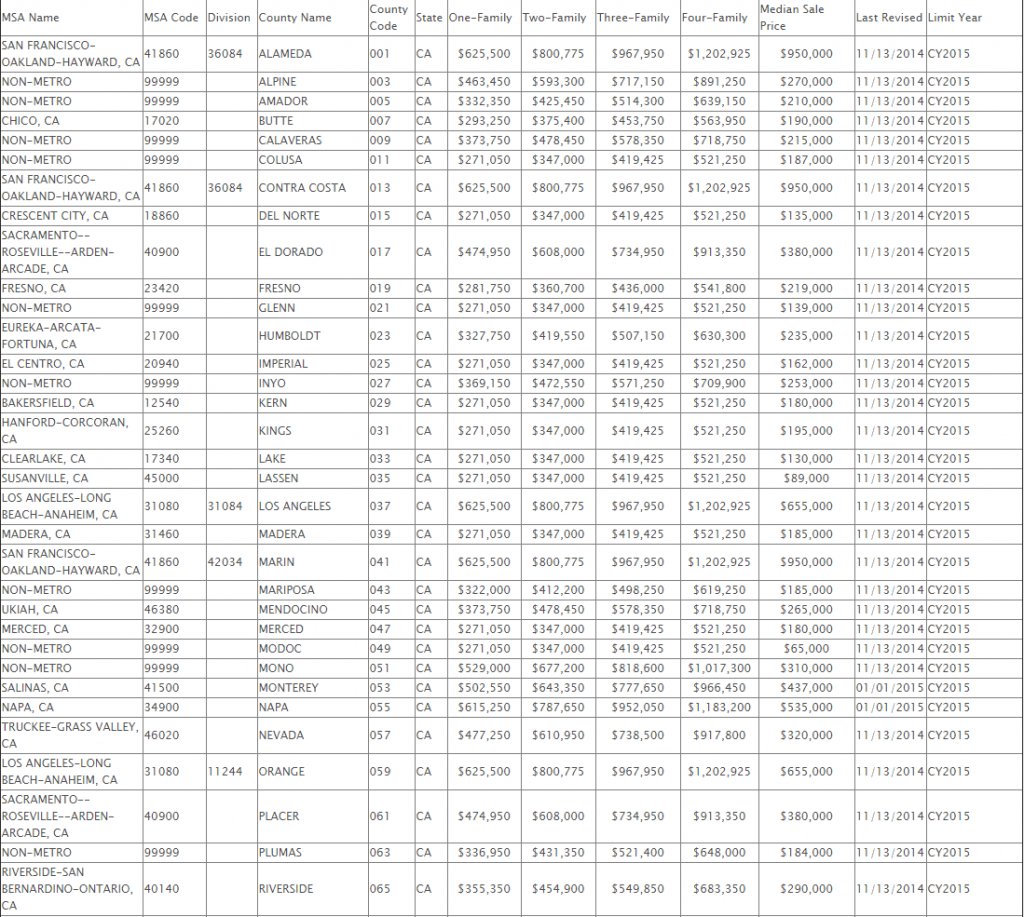

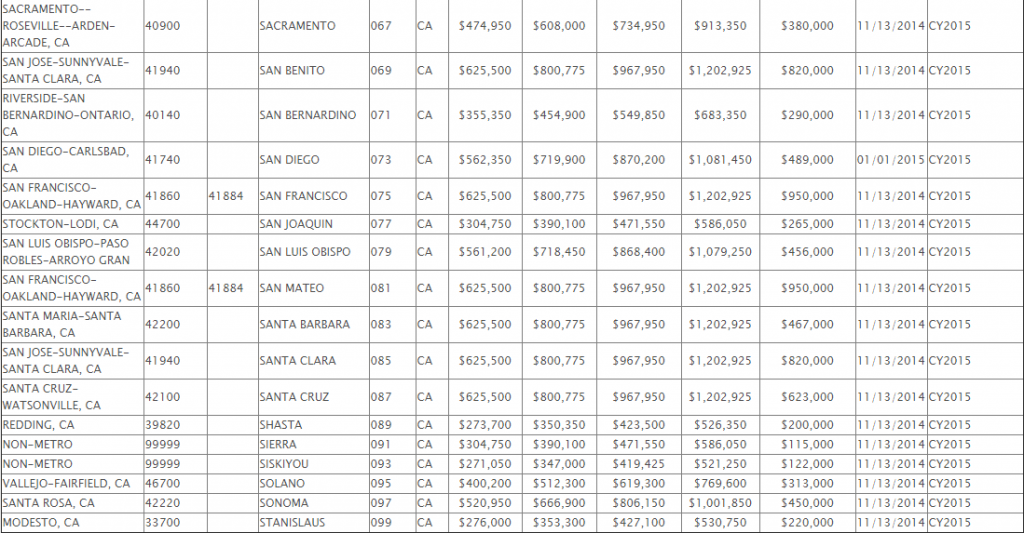

- Loan amounts as high as $625,500 with only 3.5% down payment (County specific) – Examples: San Diego county up to $580,750, Los Angeles county up to $625,500, Riverside county up to $356,500, Orange County up to $625,500, San Bernardino county up to $356,500

- 6% seller concessions

- Qualify with less-than-perfect credit

- No appraisal required in some instances (refinance)

- No pre-payment penalties

Disadvantages of a FHA loan are:

- You must pay monthly mortgage insurance

- You could potentially have the monthly mortgage insurance indefinitely – ask Derek for more details on this

Additional Considerations

- To qualify for an FHA loan, the subject property must be “FHA approved” – and the approval process requires several important steps. This is most important when purchasing a condominium. The entire complex must be FHA approved. Be sure to ask Derek to check to see if the complex you are looking at is FHA approved or not. You can also check here if you want.

- If you are buying a “flipped” property, you must wait 90 days from the day the investor bought it, to buy it.

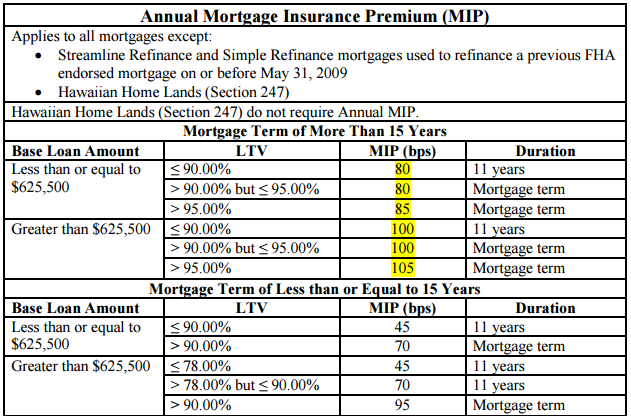

- FHA loans require an upfront Mortgage Insurance Premium (MIP) of 1.75%, and .85% annually (paid monthly) on a 30 year fixed loan with > 95.00% LTV (if loan is a 15 year fixed and less than 95.00% LTV, the premiums decrease).

CURRENT FHA MONTHLY MORTGAGE INSURANCE

(click image to make bigger)

2015 CA FHA LOAN LIMITS BY COUNTY

(click images to make bigger)

FHA Streamline Refinance

An FHA refinance program with reduced documentation requirements and faster processing time than a full FHA refinance. This is available to current FHA mortgage holders who want to reduce their monthly payments by refinancing to a lower interest rate. For more information click here to be taken to the main FHA Streamline Refinance page.

FHA 203K Renovation Loans, Great for Fixer Uppers (but a pain in the you know what)

The FHA 203K Renovation Loan Program provides you with the money to purchase a home and renovate it, all with one convenient loan. This program is ideal for purchasing foreclosures and improving their value with needed repairs and upgrades. With one loan, there is only one application, one set of fees, one closing and one monthly payment. You can finance up to an additional $35,000 into your mortgage to improve or to upgrade your home. You can quickly and easily tap into cash to pay for property repairs or improvements. Improvements can include anything that adds value to the home, such as a room addition, new carpeting, landscaping, plumbing, roofing or a new kitchen. The loan can also be used for energy-efficiency improvements.

The 203K Renovation program features:

- More money. The amount of money you are permitted to borrow for the purchase and renovations is based on the increased value of the home after improvements are made.

- Lower monthly payments. Your renovation costs are spread throughout the entire term of the loan, so your monthly payments may be lower than other financing options.

- Tax deductibility. The interest on the cost of your improvements, included in your mortgage, may be tax deductible. (consult your tax professional)

- Speed. Start making improvements immediately after closing. No need to wait to put in that modern kitchen or new roof. And, no need to pass up a house that’s in the ideal location but needs improvement.

- Simplicity. One application, one set of fees and closing costs, one closing to attend and one payment each month

A 203K loan can create huge value for home shoppers looking to:

- Buy a home in a neighborhood that they could not ordinarily afford by purchasing a fixer-upper.

- Include all upgrades and repairs in one loan.

- Purchase a home with only 3.5 percent down payment on the total sales price plus the cost of repairs.

- Streamline the process because closing occurs first, and then repairs are done after closing. You receive your commission and the seller receives their payoff sooner.

- Replace anything from carpet, paint and appliances, to fixtures, windows and more, and include it in the financing.

- Upgrade by adding additions and putting in landscaping.

- Fix damaged homes – new roof, fire damage, termite removal and mold remediation.

- Maximize a property’s potential. The loan is based on the after-improved value – what the house will be worth once the renovations are complete.

- Customize the home to the buyer’s taste.

- Purchase and rehab a foreclosure

Make the renovations you want…now!

Call Derek today to see if you qualify and get your personalized rate quote for an FHA loan.

C2 Financial Corporation is approved by FHA as an agent and has the ability to broker FHA loans to FHA Approved Lenders. Or C2 Financial Corporation is approved to originate VA loans, and has the ability to broker such loans to VA approved lenders. C2 Financial Corporation is not acting on behalf of or at the direction of HUD/FHA or the VA.