VA Loans For Veterans and Active Military

As one of the top lenders for VA loans in California and especially San Diego, C2 Financial knows how to do VA loans. We can do VA loans up to $6,000,000, which is a lot higher than most other mortgage companies.

VA loans, also called Veteran Administration loans, are available to active military service members, Veterans, National Guard or reservists, surviving spouse of a veteran and members of the Public Health Service. The VA loan program can make it much easier for veterans to secure a home loan by requiring little or no down payment. This home loan is available to Veterans and guaranteed by the U.S. Veteran’s Administration, and it frequently offers lower interest rates than ordinarily available conventional loans.

The most outstanding feature of a VA loan is the ability to obtain 100% financing without having to pay private mortgage insurance every month. A funding fee is paid to the VA at closing and the fee may be included in the loan, depending on the loan amount.

VA loans have a number of advantages including:

- Buy a home with no down payment or refinance up to 100% of your home’s value

- No prepayment penalty

- Down payment and closing costs may be a gift

- No monthly Mortgage Insurance

- 4% seller concessions

- High Balance loan amounts

- Qualify with less-than-perfect credit

- Lower closing costs

- No appraisal required for select borrowers (refinance)

- Most VA loans are assumable

What are the VA loan limits?

Although the maximum loan amount varies with property location, typically the maximum, no money down, loan amount for VA loans in San Diego County, is $649,750. Higher loan amounts are also available through a combination of down payment and the Veteran’s available eligibility. Remember, we can go up to $6,000,000 with a down payment on a purchase. On a VA refinance, we can go up to a loan amount of $1,000,000. Tip – As the loan amounts increase, so do the credit score requirements. Below are the maximum loan amounts, per county, for 2018 that you can go to with $0 down payment.

What is the VA Funding Fee?

VA loans do NOT have mortgage insurance (even though you can get a loan with zero down payment up to your county limits). Instead, Veteran’s are charged a funding fee based on Veteran’s service type, loan transaction type (purchase or refinance) and the Veteran’s prior use of VA entitlement (has the Veteran used his/her VA loan before?). The funding fee is collected one of three ways. 1) financed into the loan 2) paid for upfront in cash at the close of escrow 3) combination of cash upfront and financed into the new loan.

The amount of the Funding Fee is a function of the Veteran’s available eligibility. Click here to see what your funding fee will be. This fee depends on certain factors such as if you have used your VA loan before, are you active military or are you in the reserves or national guard, etc.

Can the VA Funding Fee be waived?

Certain borrowers are Exempt from paying the VA Funding Fee

- Veterans receiving VA compensation for service connected disability

- Surviving spouse of the Veteran who died from in service or from a service connected disability

- Active Duty Personnel that have been rated to receive disability compensation

What terms apply to VA loans?

Eligible products up to conforming loan limit (1- 4 unit properties)

- 15-, 25- and 30-year fixed-rate

- 5/1 Treasury ARM

Eligible products for High Balance

- 30-year fixed-rate

- 5/1 Treasury ARM

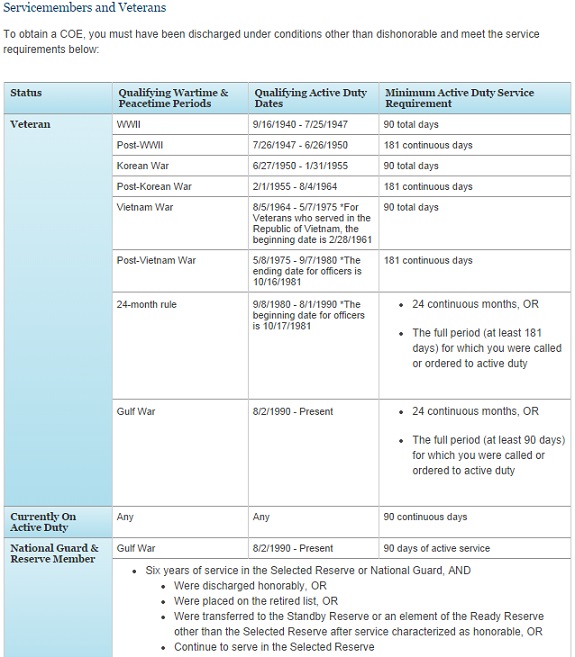

VA Loans Eligibility – (click picture to see more)

VA Fundamentals –

VA program guidelines for occupancy, transaction type and properties

Occupancy Requirements:

- Owner occupied; Non-owner allowed on IRRRL (VA refinance)

Transaction Types:

- Purchases, IRRRL, & Cash Out (note: paying off non-VA loan is cash out even if not getting cash or paying off debts)

Property Types:

- SFR (attached & detached) & PUD

- Condos (VA approved)

- 2-4 Units

- New Construction

- Leased Land (need lease approved)

Maximum seller contribution is 4%

VA Income & Employment Guidelines

Employment History

- 2-Year employment history is required

Documentation Required

- Verification of Employment (VA 26-8497)

- LES Statement

Other factors considered –

- Income must be considered stable

- Overtime, Bonus, 2nd Job & Commissions

- Gaps in employment

- Employment < 1 year (additional documentation will be required)

- Self-employment: 2 year history but < 2 years and > 1 year may be possible

- 4506-T required (IRS form)

- Rental Income from current residence (rent offsets mortgage only)

- Rental income from subject 2-4 residence

- Rental income from other properties

Active Duty Personnel

- Leave & Earnings Statement is required in lieu of a VOE

- Must verify anticipated Separation Date via the LES

- Military pay for Quarters or Housing may be allowed

- Income from Reserves or National Guard may be allowed

- VA Form 26-0592 Counseling Checklist for Military Homebuyers is required

VA program’s approach to Credit & Debt

- Tri-merge credit report

- Community property states & Non-purchasing Spouse (considered to qualify)

- Clear CAIVRS

- VA Form 26-0551 Debt Questionnaire

- Bankruptcy – Chapter 7 (2 year seasoning)

- Bankruptcy – Chapter 13 (must be in payment period 12 months)

- Foreclosure (3 year seasoning)

- Collections and Charge-offs

- Judgments and Tax Liens (must be paid)

- Credit Counseling

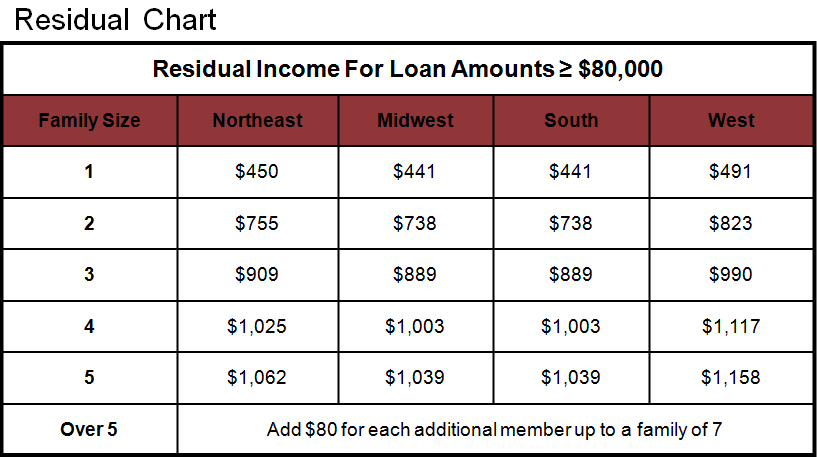

Residual Income – What the heck is this?

The VA requires that to qualify for a VA loan, you must have residual income left over every month after deductions of all debts, obligations, taxes and social security, and monthly housing including maintenance and utilities. This income will be used to cover the family’s living expenses such as food, health care etc. It also takes into account the number of people in your household. It is a calculation that is done during qualifying. Below is a chart that shows how much is required for where you live and how many people are in your family.

Conventional vs. VA Loans

- As a result of changes to the mortgage industry, options for a conventional loan with $0 Down have evaporated and a VA Loan is one of the only $0 Down home loan options.

- You can also save money each month since you do not have to pay PMI. PMI is private mortgage insurance and can cost hundreds of dollars per month. Plus, you can even qualify for lower rates by using your VA Benefits.

- The seller can pay for most of the buyers closing costs on a VA loan, resulting in (most of the times) very low closing costs for VA buyers.

- Down Payment (when required) and closing costs may be funded by a gift or grant

Down Payment – VA Offers $0 Down

- In today’s market, banks are generally asking for 10-20% down on a conventional loan. Because a VA Loan is backed by the federal government, banks do not require a down payment making a VA Loan one of the only loan programs that can still offer 100% financing.

Monthly Payment – Save Every Month with VA

- Because the loan is backed by the government, banks do not require PMI (private mortgage insurance), an added monthly expense required for conventional loans where the borrower finances more than 80% of the home’s value.

- A VA borrower has an advantage when shopping for rates as well. Interest rates are based on the banks capital risk should the loan go into default, but because a VA Loan is backed by the government the bank takes less risk. VA borrowers benefit with an even more competitive rate because the banks risk is offset. This, along with no PMI can substantially lower your monthly payment.

Qualification Standards – VA is More Lenient

- The qualification standards for each loan type are very different. Once again, because the loan is backed by the government, banks assume less risk and have less stringent qualification standards for VA Loans making them easier to obtain.

VA Interest Rate Reduction Refinance Loan (IRRRL) – Click Here for more info on this incredible program

A VA refinance loan with reduced documentation requirements and less processing time that a full VA refinance. No appraisal needed in some cases. This is available to current VA mortgage holders who want to reduce their monthly payments by refinancing to a lower interest rate. Closing costs on this refinance may be financed in to the new loan. There is also no income or asset documentation required.

Find out if you are eligible for a VA Interest Rate Reduction Loan. Call Derek today to get your personalized rate quote for a VA loan. Also, this may be a 2nd home or an investment property now, if it was originally an owner occupied property.

Before you start the loan process, you’ll need to have some information at hand for all loan applicants:

- Social Security numbers

- Residence addresses for the past two years

- Names and addresses of your employers over past two years

- Your current gross monthly salary

- Names, addresses, account numbers and balances on all checking and savings accounts

- Names, addresses, account numbers, balances and monthly payments on all open loans

- Addresses and loan information of other real estate owned

- Estimated value of furniture and personal property

- Certificate of Eligibility and DD214, (for veterans only)

- W2’s for the past two years and current check stubs

- For self-employed individuals, you will need to provide personal tax returns for the past two years, current income statement and balance sheet for the business

In addition, you will need to pay for a credit report and appraisal of the property.

Please contact Derek today for more information regarding VA loans and how they can work for you.

If you need help obtaining your Certificate of Eligibility, I can help you!

If you need help obtaining your DD-214, I can help you!

The services referred to herein are not available to persons located outside the state of California. This licensee is performing acts for which a real estate license is required. C2 Financial Corporation is licensed by the California Bureau of Real Estate, Broker # 01821025; NMLS # 135622. Loan approval is not guaranteed and is subject to lender review of information. Loan is only approved when lender has issued approval in writing. Specified rates may not be available for all borrowers. Rate subject to change with market conditions. C2 Financial Corporation is an Equal Opportunity Mortgage Broker/Lender. The services referred to herein are not available to persons located outside the state of California. C2 Financial Corporation is approved to originate VA and FHA loans, and has the ability to broker such loans to VA and FHA approved lenders. C2 Financial Corporation is not acting on behalf of or at the direction of HUD/FHA or the VA.