FHA Streamline Refinance – Lower your rate and monthly mortgage insurance premium without the hassles of a full refinance!

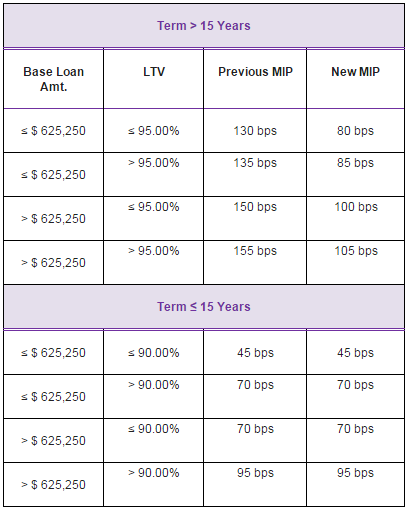

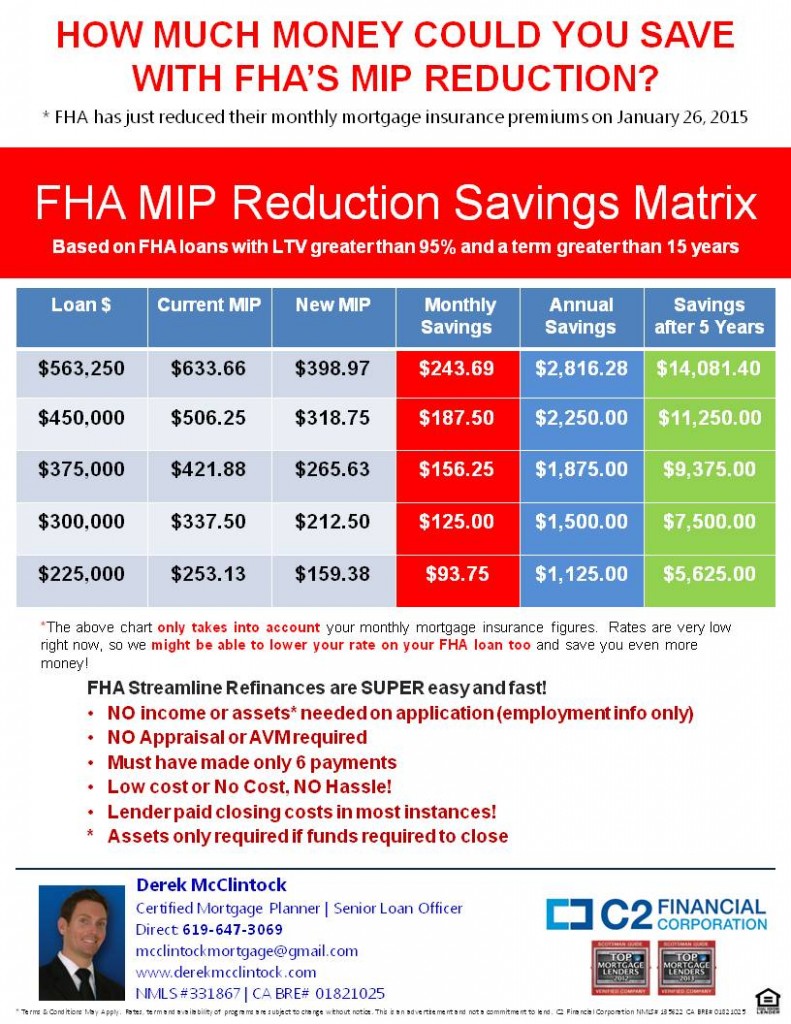

FHA just lowered their monthly MI by 1/2 point (January 2015 see below), so if you currently have an FHA loan, it would be very wise to have me run your numbers again and see how much I can save you on a streamline refinance. This is an FHA refinance program with reduced documentation requirements and faster processing time than a full FHA refinance. This is available to current FHA mortgage holders who want to reduce their monthly payments by refinancing to a lower interest rate.

- Must have made 6 payments on your FHA loan

- Must not have been late on your mortgage payment within the last 12 months

- Must be living in the property

- Must have at least 5% net tangible benefit from the refinance – refinance from an ARM to a fixed rate or 5% reduction on PIMI

- Max cash back at closing $500

Where it Gets Good

- No appraisal

- No income disclosed

- Credit report is for score and mortgage rating only

- No 4506T required from the IRS

- 2 year employment history

- Max 50% DTI

All I Need From You

- Application

- Copy of Note and Deed of Trust (can get note from your servicer and deed from escrow if you can’t find it)

- Current mortgage statement

- Copy of driver’s license and social security card for all borrowers

- Signed C2 Financial disclosures we give you

Get Started

Getting started on your FHA Streamline Refinance is easy and the whole process can be completed in a surprisingly short amount of time. Call or email Derek today to get your free FHA Streamline Refinance quote. It only takes a couple minutes to potentially save tens of thousands of dollars!

C2 Financial Corporation is approved by FHA as an agent and has the ability to broker FHA loans to FHA Approved Lenders. Or C2 Financial Corporation is approved to originate VA loans, and has the ability to broker such loans to VA approved lenders. C2 Financial Corporation is not acting on behalf of or at the direction of HUD/FHA or the VA.